Introduction: A New Trade Reality

In a significant move this July 2025, the United States imposed a 19% import tariff on select Indonesian goods, signaling a recalibration of its trade posture in Southeast Asia. In exchange, Indonesia committed to eliminating over 99% of tariffs and non-tariff barriers for US goods, covering sectors from agriculture and healthcare to technology and automotive.

While these changes may seem diplomatic on the surface, their impact runs deep, particularly for businesses navigating the complex web of supply chains, pricing, and cross-border logistics.

This article unpacks the implications of the tariff shift and how Indonesian companies can build resilience amid increasing volatility, with the right strategies, and with the right partners.

1. What Changed? Understanding the 19% US Import Tariff

The new tariff, announced in July 2025, applies to a wide range of Indonesian export categories, notably:

- Footwear and garments

- Processed food and palm oil derivatives

- Automotive components

- Paper and packaging products

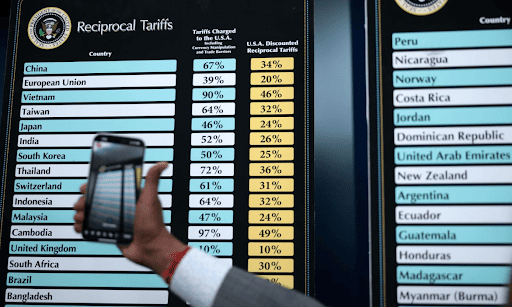

The previous threat of a 32% tariff was reduced through trade negotiations, but the 19% rate still presents substantial cost burdens for exporters targeting the US market.

This move aligns with broader US efforts to rebalance trade partnerships and reduce reliance on Chinese imports, positioning Indonesia as both a beneficiary and a bargaining chip in the new global supply equation.

2. The Business Impact: Stress Points in the Supply Chain

a. Front-Loading Frenzy

Leading up to the official tariff announcement, freight data showed a spike in shipments from Indonesia to the US, a classic case of “front-loading” as businesses rushed to clear inventory before duties took effect.

This behavior, while short-term, reflects longer-term uncertainty in how businesses plan procurement and inventory.

b. Margin Pressure on Exporters

For manufacturers, the tariff translates into higher landed costs. Without pricing power to pass costs downstream, margins shrink, and competitiveness weakens, especially for SMEs with fewer buffers.

c. Supply Chain Disruption

As tariffs add volatility to cost structures, businesses are rethinking their sourcing, warehousing, and shipping strategies. The need to diversify suppliers and restructure logistics is becoming urgent, especially for exporters relying heavily on the US.

3. A Strategic Crossroad for Indonesian Companies

In this new trade environment, Indonesian companies must pivot from reactive to strategic:

- Cost forecasting must now include tariff risk and scenario planning

- Supplier networks must be mapped for alternative sourcing routes

- Inventory strategies need to accommodate sudden shifts in delivery lead times and warehousing costs

- Trade compliance and documentation processes must be watertight to avoid penalties

These are not just operational concerns, they’re strategic priorities that can determine survival or growth.

4. Where Sinergis Comes In: Your Partner for Resilient Operations

At Sinergis, we help companies turn uncertainty into strategy. Here’s how our team can support your operations:

- Supply Chain Risk Assessment

We provide end-to-end mapping and analysis of your current supply chain, identifying vulnerabilities related to cost, timing, and sourcing concentration.

- Scenario-Based Planning & Forecasting

With tariff scenarios and policy shifts in mind, we guide you in building flexible forecasting models to keep your pricing, inventory, and procurement agile.

- Supplier Diversification Strategy

Our network and research capabilities can help you identify alternative regional suppliers, whether to mitigate tariff exposure or improve fulfillment capacity.

- Integrated Operations Support

From SOP documentation and vendor coordination to data-driven logistics advisory, we streamline your operations while keeping compliance front and center.

Conclusion: Building Resilience Beyond Tariffs

Tariffs may be outside of our control, but how we response to it isn’t. The 19% US-Indonesia tariff is a wake-up call for businesses to build more resilient, adaptive, and insight-driven supply chains. It’s also a signal that cross-functional collaboration, from procurement to HR, from logistics to compliance, is no longer optional.

With Sinergis HR Consulting & Services as your strategic partner, we’re here to help you go beyond survival and build sustainable strength. Let’s talk about what resilience means for your business today.